Athena Invest - Commentary

by Craig Love, on August 31, 2021

Financial Planning as a North Star

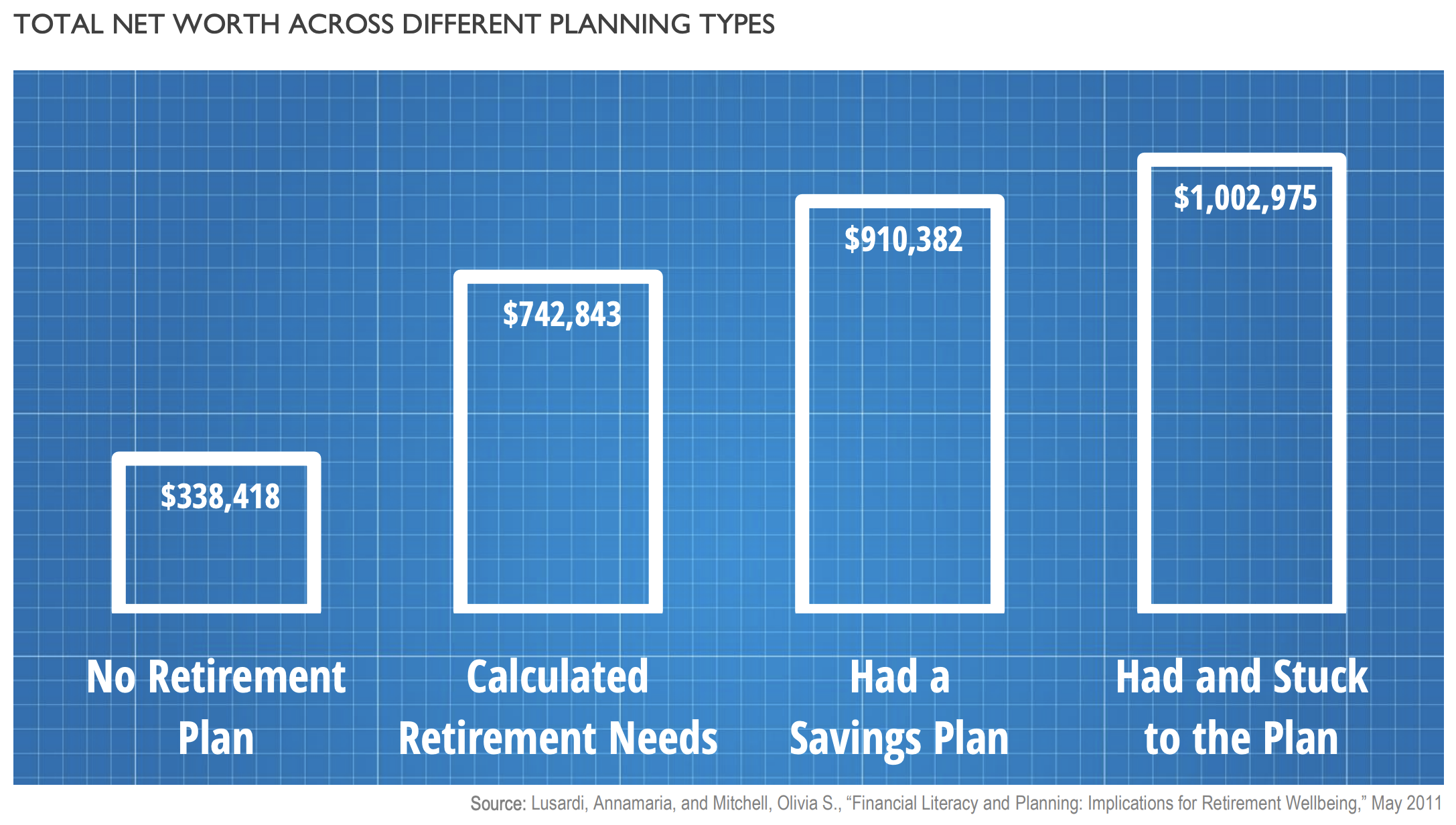

The daily stream of events and the accompanying wave of pundit opinion can take its toll on weary investors and leave them in a state of angst about the markets and their investments. Planning is a powerful tool to help investors to refocus on their long-term goals and stay on track. The chart below highlights the benefits of planning taken from a study on retirement planning among Americans over age 50 in a wide range of market conditions.

The study analyzed the following four categories of planning and their impact on net worth:

- Those who had no plan.

- Those who thought about planning by calculating how much they needed for retirement.

- Those that had a plan for how to save the money needed.

- Those that had a plan and stuck to it.

Not surprising, having and sticking to a plan generates the best outcome. What may be surprising is the magnitude of the impact of planning and that any amount of planning results in two to three times the wealth. Even just calculating the amount of money needed for retirement improves results dramatically.

Having a plan simplifies investing and allows investors to focus on things they can control. Contributions, withdrawals and the amount of time invested are all drivers of long-term wealth. These actions are enabled by planning which creates awareness and encourages long-term thinking along with consistent action over time. Putting current events in a longer-term context and focusing on what you can control with practical planning can help to relieve stress and avoid costly mistakes.

What is going on?

1. Strong emotions and behavioral biases including, anchoring, loss aversion, cascading along with recency and availability bias can cloud our thinking.

2. We are prone to emotional overreaction when under stress because our cognitive functions are diminished by our emotions. This can lead to poor decisions at precisely the wrong time and often results in costly mistakes.

3. Building wealth requires discipline and delayed gratification, where current benefits are traded off for long-term benefits. We are unlikely to engage in this trade off without systems 2 thinking, requiring a conscious process that identifies future value and a method for obtaining it.

What can we do?

1. Develop a needs-based plan as a financial roadmap and to help Illustrate the value of having and following a plan.

2. Realistic and practical planning discussions along with relevant behavioral coaching can provide essential support during turbulent times.

3. Take a longer-term perspective and focus on what you can control with predetermined courses of action.

4. Have a disciplined investment process and learn that progress toward goals is often more important than short-term performance.

5. Work with a financial advisor who can provide valuable perspective and guidance to help you stay on track.

Source: Athena Invest

DISCLOSURES

The information provided here is for general informational purposes only and should not be considered an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. It should not be assumed that recommendations of AthenaInvest made herein or in the future will be profitable or will equal the past performance records of any AthenaInvest investment strategy or product. There can be no assurance that future recommendations will achieve comparable results. The author’s opinions may change, without notice, in reaction to shifting economic, market, business, and other conditions. AthenaInvest disclaims any responsibility to update such views. These views may not be relied upon as investment advice or as an

indication of trading intent on behalf of any AthenaInvest. You are solely responsible for determining whether any investment, investment strategy, security or related transaction is appropriate for you based on your personal investment objectives and financial circumstances. You should consult with a qualified financial adviser, legal or tax professional regarding your specific situation. Investments involve risk and unless otherwise stated, are not guaranteed. Past performance is not indicative of future performance.