Athena Invest - Commentary

by Craig Love, on December 05, 2020

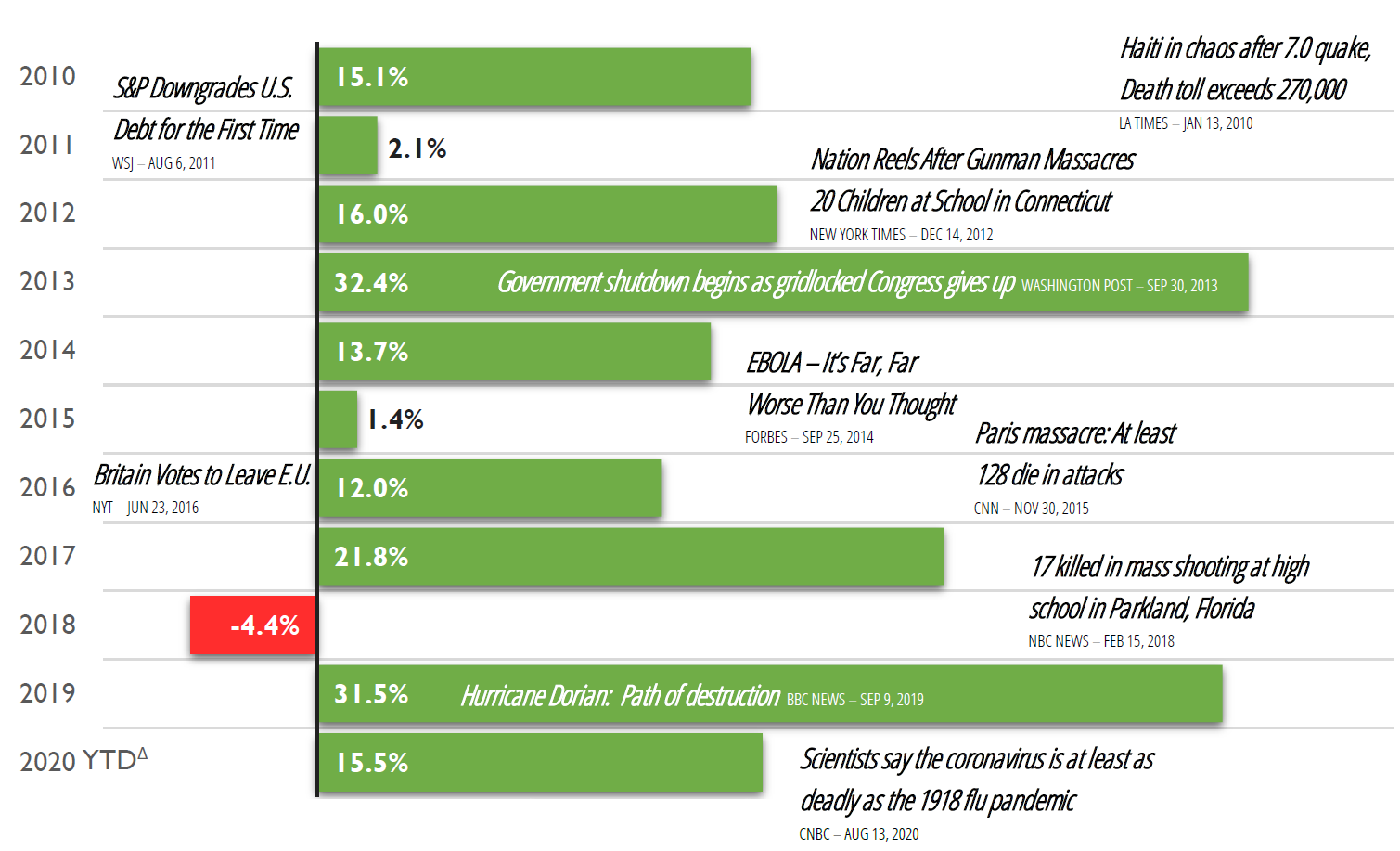

After the year we have had its easy to understand how investors may have become fatigued and disoriented. Taking a step back and looking at things over a longer time period can help to regain a sense of balance and perspective. The ability to look past today’s headlines is key to long-term investing. Over the ten-year period of 2010 – 2019, the market generated an impressive annualized return of 13.6%, but you would not have known it from the headlines.

ANNUAL RETURNS AND SELECTED HEADLINES (S&P 500 TR INDEX JAN 2010 – NOV 2020)

Δ 2020 YTD return is Jan 1, 2020 – Nov 30, 2020 and is not annualized. Source: AthenaInvest, Inc. and S&P Dow Jones Indices LLC

Investors worry about whether some event is going to turn into a market rout and agonize over whether they should get back in the market, stay invested or get out and stay on the sidelines. Of course, pundits, commentators, and social media fuel the fire by issuing warnings about everything that goes wrong with the world, the economy, markets, and other potential disasters. Meanwhile, politicians, economists and experts give conflicting predictions about the consequences from the same data. Altogether, these unsettling world events are amplified by opinion and media hype creating an underlying state of constant worry.

But for all the headlines and mouse clicks, usually the right thing to do is to stay fully invested. It is not that these events are not important, it is just that reacting to them is not a reliable way of making long-term investment decisions. History has shown that the US economy and stock market are incredibly resilient with the capacity to weather the storm of a wide range of events. While pullbacks are inevitable, history shows the best course of action is to stay invested and focus on your long-term goals.

From the Behavioral Viewpoint

- Events and the constant chatter about them create a negative availability bias, in which a never-ending stream of dramatic events have the potential to change everything. While this is good for cable ratings and social media clicks, it creates anxiety for investors.

- Pundits and media opinion trigger our social validation and herding instincts. Where we are on the lookout for danger and should be prepared to flee. While useful on the Serengeti, this is not particularly helpful in making sound investment decisions.

- We overestimate our abilities to determine when to exit and when to get back into the market. On the other hand, we underestimate the true randomness of world events. This overconfidence bias results in emotional buying and selling or sitting on the sidelines and missing out on subsequent returns

What can we do?

- The key to ignoring the constant chatter and media hype is to have a disciplined approach that keeps your emotions in check. Of Course, turning off the media and going outside also helps.

- Use needs-based planning to separate short and long-term investments. This can insulate your emotions from short-term market events while allowing long-term investments the time they need to mature.

- An experienced financial advisor, who has lived through many market environments, can also provide valuable perspective and coaching that can help you stick to the plan and stay focused on long-term goals.

Source: Athena Invest