Athena Invest - Commentary

by Craig Love, on March 16, 2021

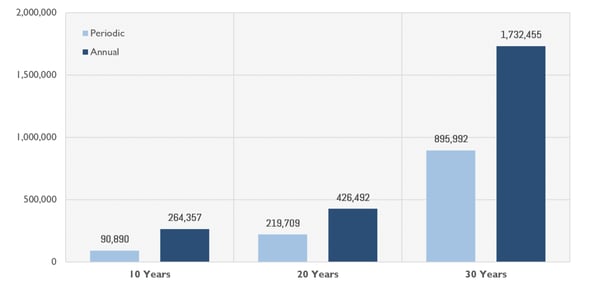

Many investors wait until they have “enough” money or for when it’s “a good time” to invest in the market. Making regular contributions regardless of these concerns is one of the most powerful ways to build wealth. The table below highlights the value of making regular contributions compared to periodic contributions over 10-, 20- and 30-year periods. Even though the same principal amount is invested, the result is dramatically different with nearly twice the wealth creation.

RESULTING VALUES OF PERIODIC VERSUS ANNUAL CONTRIBUTIONS (S&P 500 TR INDEX JAN 1991-DEC 2020)

Δ 10-year return is 1991-2000, 20-year return is 1991-2010, and 30-year return is 1991-2020. Source: AthenaInvest, Inc. and S&P Dow Jones Indices LLC

Δ 10-year return is 1991-2000, 20-year return is 1991-2010, and 30-year return is 1991-2020. Source: AthenaInvest, Inc. and S&P Dow Jones Indices LLC

The table highlights two investors over a 30-year period. “Annual Annie” who invests $10,000 every year compared to “Later Lucy” who invests $100,000 periodically at the end of every 10 years. Regular contributions benefit from investing earlier and the subsequent compounding. Over longer time periods the results are dramatic with roughly twice the wealth creation for 10-, 20- and 30-year periods.

Rather than worry about if you have “enough” and when it’s “a good time” to invest, you will be better served by simply investing whatever you can as consistently as possible. Behaviorally it is much easier to pay yourself first and learn to live within the funds you have left than it is to sporadically make larger investments in an effort to time the market. It turns out that consistent actions are more important than short-term market conditions in building long term wealth.

From the Behavioral Viewpoint

- Investing is an exercise in delayed gratification, that requires taking an action now for some benefit in the future. Unfortunately, we are hardwired for instant gratification.

- We under-estimate the long-term value of regular contributions and compounding. We think we need a substantial amount before we can invest and are a poor at estimating long-term probabilities and results.

- Recency and availability bias cause us to anchor on short-term conditions and we become overly concerned with asking if now is “a good time” to invest.

- Fear, loss aversion and potential regret create emotional turmoil and a tendency to delay contributions.

What can we do?

- Use needs-based planning to develop a plan for liquidity, income and growth including specific plans for funding your growth portfolio.

- Pay yourself first, by making regular contributions, contribute early and often. Supplement your regular contributions whenever you can with excess funds or windfalls to accelerate growth.

- Have a disciplined investment process with a strategy-diverse growth portfolio and stay fully invested over time.

- Work with a professional financial advisor who can provide valuable guidance to help develop a plan and stay on track.

Source: Athena Invest