Kensington - Commentary

by Craig Love, on August 13, 2021

As we head into the Fall, uncertainty continues to overshadow the investment landscape. With over a year into the recovery already passed, investors are struggling with the need to stretch for return in a yield-starved environment in the face of historically elevated valuations, the threat of rising inflation and other potential hazards to economic growth, including renewed lockdown risk in response to the spreading COVID-19 Delta Variant. These economic crosscurrents are focusing attention on the ability of the monetary authorities to maintain an accommodative stance. Fed policy must maintain a delicate balance that assures a containment of inflationary momentum, while imparting confidence to the marketplace that it continues to be sufficiently accommodative to sustain the economic recovery.

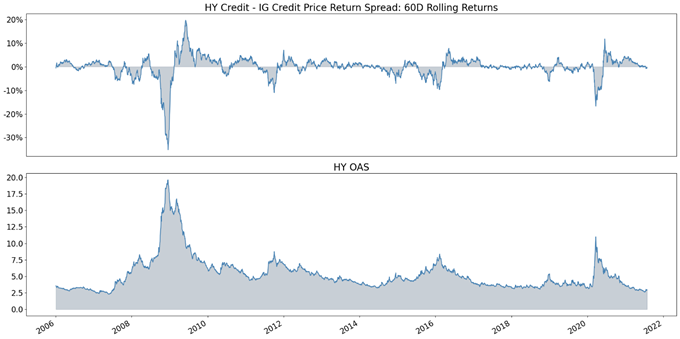

As depicted in Figure 1 below, February marked the beginning of a slow erosion in the demand for risk in fixed income. The relative attractiveness of high yield over investment grade credit has declined, with the rolling price return spread of their respective indices touching zero in May and moving sideways since.

Figure 1. Top Panel: Bloomberg High Yield Corporate Index (LF98TRUU) and the Bloomberg Investment Grade Corporate Index (LUACTRUU) prices return spread. The spread reflects an adjustment to account for differences in duration between the two indices. Bottom Panel: Bloomberg High Yield Corporate Index Option Adjusted Spread. Calculations performed by Kensington Asset Management.

This isn’t to imply a correction is imminent for high yield credit, but it does imply that future returns from the asset class are more likely to come from coupon payments as opposed to price appreciation. This is supported by the compression of high yield credit spreads to near historic lows as shown in the lower chart of Figure 1. The takeaway is that marginal buyers of the asset class will have to rely more on the coupon component of returns and weigh that against the potential for default risk or downgrades.

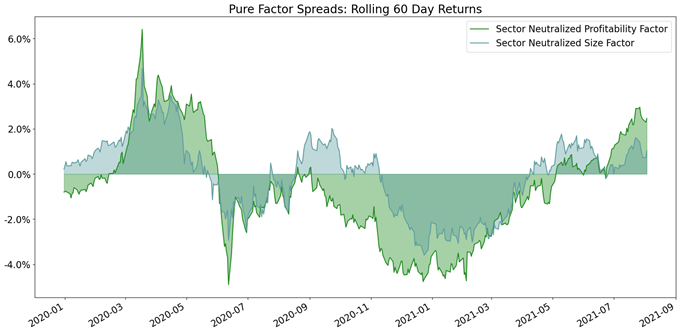

The shift in investor risk preferences for higher quality investments are also reflected in the equity market. To gauge this, we can take a cursory look at the rolling performance of a couple of market and sector neutral equity factors, as shown in Figure 2. The chart illustrates two factors that relate to default risk: profitability and size. All else being equal, more profitable companies and/or larger companies are less likely to default on their loans. We can see the performance of these factors began to improve in February of this year and match the movements of the High Yield/Investment Grade return spread (albeit in the opposite direction).

Figure 2. Bloomberg Pure Profitability (PPROFTUS) and Bloomberg Pure Size Factor (PSIZEUS) rolling 60 Day returns. The pure factors control for market and sector exposures to isolate performance of the factor. Calculations performed by Kensington Asset Management.

Again, this isn’t to stoke fear or imply any type of correction, but it does provide a good description of market participants’ shifting preferences. Given the gains made from the reflation trade since last year, and in the face of potential tapering, September seasonality, and pandemic uncertainty, it’s very sensible for participants to be reducing the risk in their portfolios by investing more defensively.

In managing Kensington Asset Management’s strategies, we take the shifting nuances in demand for risk into account when designing portfolios. Our clients should take comfort that protection of investment principal is top of mind, especially at the more advanced stage of a market cycle. The core of Kensington Asset Management’s tactical approach to defensive investing is a model driven process that strives to capture market trends when risk is justified and switches to mitigating risk as markets fall.

Best regards,

Kensington Asset Management Team

Source: Kensington Asset Management