Kensington Market Insights - July 13

by Craig Love, on July 13, 2023

Kensington Market Insights - July 13

Market Insights is a weekly piece in which Kensington’s Portfolio Management team will share interesting and thought-provoking charts that we believe provide insight into markets and the current investment landscape.

CPI Surprise

On Wednesday it was reported that inflation (CPI) fell to its lowest annual rate in more than two years during June, increasing 3% from a year ago, the lowest level since March 2021. On a monthly basis (MoM), the index, which measures a broad swath of prices for goods and services, rose 0.2%. The better-than-expected drop was a product of some deceleration in costs and an easy comparison against a time when price increases were running at a more than 40-year high. Unfortunately, that is about to change as we are about to pass the peak of the disinflationary base effects (chart below), which means unless MoM CPI stays below 0.2%, inflation will begin to head up again. Going from 9% to 4% was the easy part. 4% to 2% will probably be much more difficult to achieve.

Source: BofA Global Investment Strategy, Bloomberg

Fed Reaction

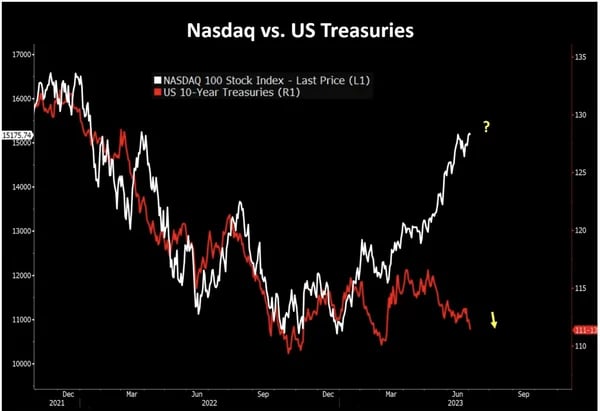

Despite the positive inflation reading, the Fed is almost assuredly still moving forward with additional rate hikes beginning this month at the July 26th FOMC meeting. So far this year equity markets have shrugged off higher interest rates, despite the higher borrowing rates they cause. Historically, the relationship between equity markets and 10-year Treasuries has tracked very closely, but this cycle has had a significant divergence (chart below). Time will tell if this is a decoupling of the relationship or if a correction in equities is in store.

Source: Bloomberg, Tavi Costa

Q2 Earnings Season

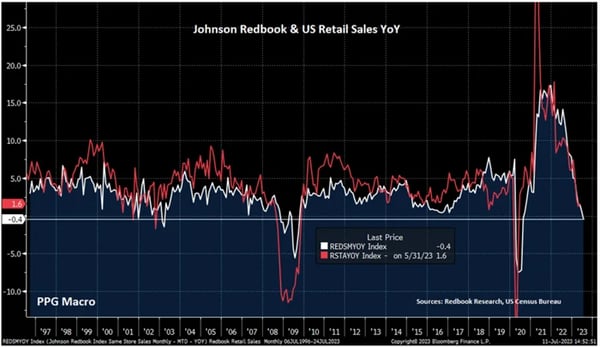

Speaking of markets, earnings season is upon us once again, and expectations are that we will see negative earnings for the 3rd quarter in a row. For Q2 2023, the estimated earnings decline for the S&P 500 is -7.2%, which has been revised down from -4.7% at the end of March. One sector that is likely to come under significant pressure is retail. On Tuesday Redbook released their monthly retail sales report, which showed a contraction in YoY sales for the first time since the pandemic, and if we ignore the pandemic, the first time since the Great Financial Crisis in 2009 (chart below).

Source: Redbook Research, US Census Bureau

Market Impact

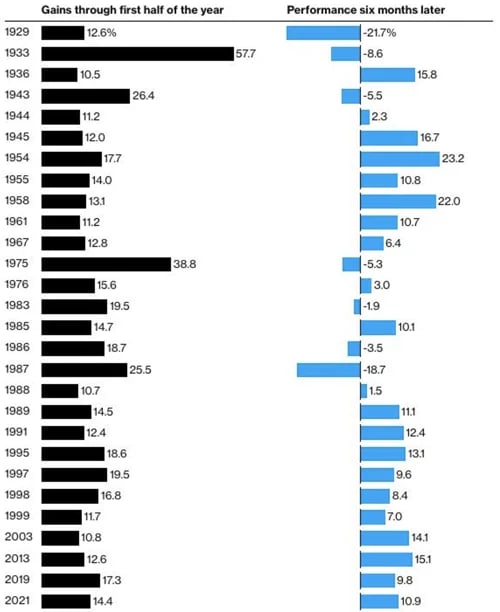

Looking ahead, it’s difficult to know what to expect from the market in the second half of 2023. Historically when the index has climbed more than 10% through June, it has typically been positive for the second half of the year as well, with a median return of approximately 10% (chart below), and only a handful of down years, with 1929 and 1987 being significant outliers.

Strong First Half Historically Bodes Well for Investors

S&P 500 returns when the benchmark index climbs at least 10% through June

Source: Bloomberg

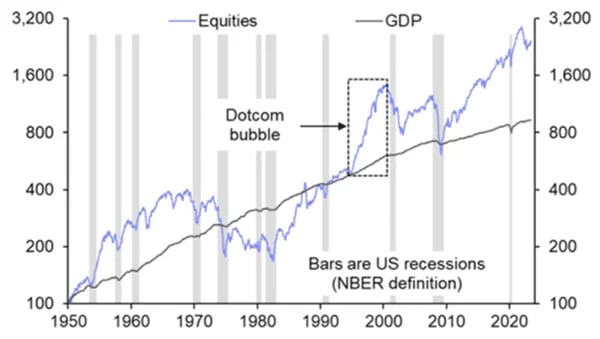

Over the longer term, however, it certainly appears a correction is in store. As you can see from the chart below, the deviation between equities and underlying economic growth is the most extreme it has been, at least dating back to 1950. Considering GDP drives earnings, an eventual reversion should be expected.

Source: The Daily Shot

If a correction is inevitable, then the question is around timing. Can the market follow historical precedent and continue its rally through year-end, or will the pressure of higher rates lead to a correction in the near term? As always, the key is to remain nimble. At Kensington, we believe a tactical approach to navigating markets is critical to avoid significant portfolio drawdowns… whenever they arise.

Forward-looking statements are based on management’s then current views and assumptions and, as a result, are subject to certain risks and uncertainties that could cause actual results to differ materially from those projected. This market insight is for informational purposes only and should not be construed as a solicitation to buy or sell, or to invest in any investment product or strategy. Investing involves risk including loss of principal.