Kensington Monthly Market Commentary: April 2023

by Craig Love, on May 19, 2023

Kensington Monthly Market Commentary: April 2023

Geopolitics: With the coming of spring also comes the well-publicized Ukraine counter offensive and an uptick in global geopolitical tensions. Russia has already increased its bombardment of Ukrainian territory to fortify their positions for the coming onslaught and to degrade morale. The success of this offensive will be crucial to the outcome of the war. As reported in the New York Times, Alexander Vershbow, a former U.S. ambassador to Russia and senior North Atlantic Treaty Organization (“NATO”) official, states that, “Everything hinges on this counteroffensive.” He added, “Everybody’s hopeful, maybe over-optimistic. But it will determine whether there is going to be a decent outcome for the Ukrainians, in terms of recovering territory on the battlefield and creating much more significant leverage to get some kind of negotiated settlement.”

Meanwhile, President Xi Jinping called Ukrainian President Volodymyr Zelensky to find common ground and open a pathway to peace. If China were to play an outsized role in resolving the conflict (as Henry Kissinger recently suggested) it would greatly reduce global tensions and elevate China’s standing within the global community. However, a proxy war between the U.S. and Russia serves many purposes for China, including spurring further discussions around the dominant role of the dollar in global commerce. While it would be foolhardy to suggest the dollar is in any danger of being supplanted as the world’s reserve currency, it’s clear China is pushing for a world in which other currencies will play a more important role in trade over time.

Stock market: Large-cap stocks continued to outperform in April, with the S&P 500 Index advancing 1.46%. In contrast, both mid-cap and small-cap indexes registered losses, with the S&P 400 Midcap index down -0.78% and the Russell 2000 Index falling -1.86%. International stocks were the best performers for the month, with the MSCI EAFE Index up 2.28%.

Year-to-date three sectors have outperformed the S&P 500 Index return of 8.59%: those being information technology, communication services and consumer discretionary. Given information technology and consumer discretionary sectors are considered cyclical (their constituent companies being more sensitive to the business cycle), the outperformance in 2023 has caught those calling for an imminent recession offsides.

This month, investors were primarily focused on two areas: Q1 earnings and the fallout from the regional banking sector crisis. With regards to the former, reported earnings have handily beaten expectations. With 420 companies having reported at press time, the aggregate results are 7.2% higher than expected. Surprisingly, earnings expectations for the S&P 500 over the next 12 months are rising after having bottomed in February.

This is not to say we have reached the bottom in this cycle. As can be seen in the chart below, over the past year, earnings have declined in stair step fashion (analysts adjusting their numbers downwards after each earnings report) and logic would dictate the pattern should continue repeating itself until the Fed ceases its efforts to slow the economy. It will be more a matter of degree rather than direction.

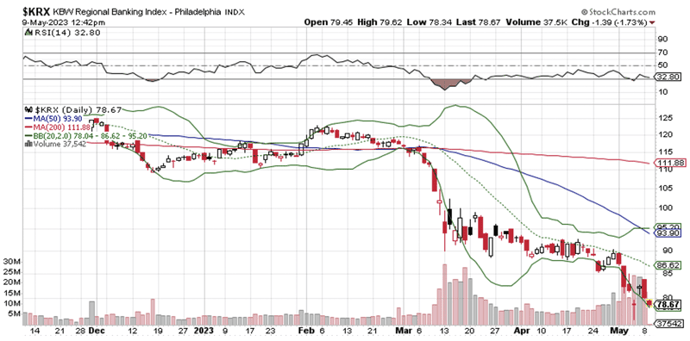

Turning to the banking crisis, investor panic appears to have subsided for now as the Federal Reserve (“Fed”) stepped in and provided liquidity to banks seeing unusually high withdrawals. Still the KBW Regional Bank Index continues to trade far beneath the levels seen before the crisis erupted, hardly indicative of the bank sector’s troubles being behind us.

Fed Monetary Policy and the Economy: At their latest FOMC meeting, the Fed raised interest rates another 25 basis points and removed from their policy statement the language, “The Committee anticipates that some additional policy firming may be appropriate.” Instead, they opted for a more dovish tone, stating that such firming would now be data dependent.

The Fed’s concern is justified regarding the potential negative effects of the regional banking crisis on the overall economy. Many of these institutions have significantly impaired balance sheets, and at the same time, they contend with a tidal wave of commercial real estate (CRE) maturities coming due over the next two years. According to Morgan Stanley strategists, about $1.5 trillion of CRE debt will come due by the end of 2025.

The Fed’s quarterly survey of bank lending conditions, SLOOS (Senior Loan Officer Opinion Survey) indicates an impending credit squeeze. Whether it will lead to an outright credit crunch remains to be seen. However, if history is any indication, the outlook is at the very least unsettled, and could quickly turn negative if fear once again grips bank depositors.

While Powell certainly doesn’t want to upset the financial system any further, he also has to address the issue of inflation, which is slowing but continues to run hotter than desired. Wage growth remains strong, and there is risk of a potential wage-price spiral leading to higher inflation expectations if not addressed. The Fed must tread a fine line, especially given how quickly confidence in banks can unravel, along with their solvency.

Moreover, the economy remains surprisingly resilient, with robust wage growth and employment numbers. Construction spending and employment have risen to new records this year, boosted by government outlays for infrastructure, a domestic manufacturing renaissance, and a wave of apartment building that got off to a slow start but has since rebounded.

Credit Markets: Bond market returns were positive in April, with the high yield sector leading at 1%. Following closely behind were investment grade corporates, which gained 0.77%, 10-year Treasuries up 0.72%, and mortgage back bonds advancing 0.52%.

In contrast to the stock market, bond investors are growing increasingly concerned about the outcome of debt limit discussions. Nowhere was this more evidenced than in the Treasury Bill market, where the yield spread between bills maturing before and after the debt limit deadline widened considerably.

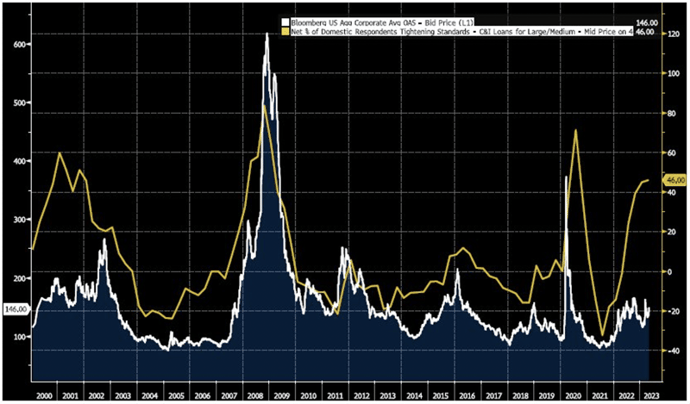

Putting aside the debt limit, we have pointed out in the past the market is anticipating a series of rate cuts later this year. While most observers view this as a positive sign that inflation will drop to a level that allows the Fed to reverse course, a more ominous take is it portends a potential credit event due to a Fed policy mistake, leading to credit dislocation. Taking that one step further, one would expect to see a widening in credit spreads, which may be purely a matter of timing, as suggested by the chart below.

Source: Saba Capital Management as of April 30, 2023

Managed Income Strategy

The Managed Income Strategy shifted to a Risk-On posture at the beginning of April, as trends in US High Yield broke to the upside after market turbulence in March stemming from fears surrounding the regional banking sector. The Strategy is positioned predominately in US High Yield, with some investment grade credit exposure to mute pricing volatility if high yield credit exhibits higher volatility. Prices remained relatively range-bound throughout the month, allowing the Strategy to take advantage of elevated yield levels in the high yield category.

Dynamic Growth Strategy

The Dynamic Growth Strategy was invested in a Risk-On posture for the entirety of the month. During this time, the Strategy was tilted toward growth equities, which continue to outpace for the year. The equity markets were relatively calm during April, yielding positive returns while trading in a relatively narrow range. The Strategy remains Risk-On as of month end. In the short term, we expect some potential for intermittent Risk-Off trades. While the general outlook remains one of lower volatility for the short term, we remain vigilant and poised to react should volatility increase.

Active Advantage Strategy

The Active Advantage strategy spent the month of April generally invested in a balanced Risk-On posture. During the month, the strategy was invested in a mix of investment grade credit, higher yielding fixed income, and equities. As with the other strategies, Active Advantage remained positioned in this way throughout the duration of the month. Although the strategy is currently positioned in a balanced posture, should volatility increase, we anticipate the model configurations will move the strategy to a more conservative posture.

Forward-looking statements are based on management’s then current views and assumptions and, as a result, are subject to certain risks and uncertainties that could cause actual results to differ materially from those projected. This market insight is for informational purposes only and should not be construed as a solicitation to buy or sell, or to invest in any investment product or strategy. Investing involves risk including loss of principal.

Disclaimer

Risks specific to the Managed Income Strategy include Management Risk, High-Yield Risk, Fixed-Income Security Risk, Foreign Investment Risk, Loans Risk, Market Risk, Underlying Funds Risk, Non-Diversification Risk, Turnover Risk, U.S. Government Securities Risk, LIBOR Risk, Models and Data Risk.

Risks specific to the Dynamic Growth Strategy include Management Risk, Equity Securities Risk, Market Risk, Underlying Funds Risk, Non-Diversification Risk, Small and Mid-Capitalization Companies Risk, Turnover Risk, U.S. Government Securities Risk, Models and Data Risk.

Risks specific to the Active Advantage Strategy include Management Risk, Equity Securities Risk, High-Yield Risk, Fixed-Income Security Risk, Foreign Investment Risk, Loans Risk, Market Risk, Underlying Funds Risk, Limited History of Operations Risk, Non-Diversification Risk, Small and Mid-Capitalization Companies Risk, Turnover Risk, U.S. Government Securities Risk, LIBOR Risk, Models and Data Risk.

Past performance is not indicative of future returns and the value of the investments and the income derived from them can go down as well as up. Future returns are not guaranteed and a loss of principal may occur. There is no guarantee any investment strategy will generate a profit or prevent a loss. Investing in securities involves risk, including loss of principal.

The types of securities held by a comparison benchmark may be substantially different from the investment strategy. An investor should consider the investment objectives, risks, charges, and expenses of the investment and the strategy carefully before investing. The S&P 500 TR Index is a capitalization weighted index of 500 stocks representing all major domestic industry groups. The S&P 500 TR Index assumes the reinvestment of dividends and capital gains. It is not possible to invest in an index, and index returns do not include management fees. The Bloomberg U.S. Aggregate Bond Index is a market capitalization-weighted intermediate term index which tracks the performance of investment grade rated debt publicly traded in the United States. It is not possible to invest directly in an index.

Investment returns will be reduced by advisory fees and other expenses charged in the management of a client’s account. You should understand how ongoing advisory fees, compounded over a number of years, reduce the value of your investment portfolio, as investment balances and potential gains on the investment balances are reduced by fees. Additional information is provided in the SEC Investors Bulletin “How Fees and Expenses Affect Your Investment Portfolio.”