Kensington Market Insights - September 21

by Craig Love, on September 21, 2023

Kensington Market Insights - September 21

Market Insights is a weekly piece in which Kensington’s Portfolio Management team will share interesting and thought-provoking charts that we believe provide insight into markets and the current investment landscape.

Fed Policy and the Impact to Bond Markets

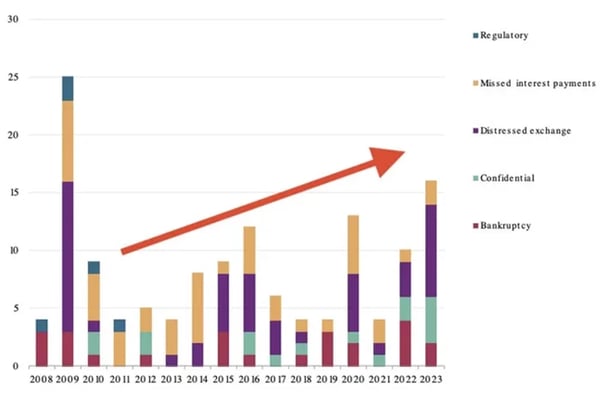

With the Federal Reserve's announcement yesterday that they would be maintaining the target Fed Funds rate in September, but noting it still expects one more hike before the end of the year and fewer cuts than previously indicated next year, it's time to assess the impact we've witnessed from higher rates so far and what may arise in the coming months. The primary consequence of a higher Federal Funds target rate has undoubtedly been the escalation of borrowing costs, affecting every sector of the economy. This includes soaring auto and credit card rates, a recent decline in housing starts due to higher mortgage rates, and, perhaps most crucially concerning the financial markets, a steady increase in commercial bankruptcies (chart below). In August, commercial bankruptcies surged by 17% compared to July and were up 54% year over year, totaling 634 commercial Chapter 11 filings for the month – the highest monthly count since 2009.

Defaults in August Reach Their Highest Monthly Tally Since 2009

(August defaults since 2009 by type)

Data as of Aug. 31, 2023.

Source: S&P Global Ratings Credit Research & Insights.

Copyright © 2018 by Standard & Poor's

Financial Services LLS. All rights reserved

Worse Before It Gets Better?

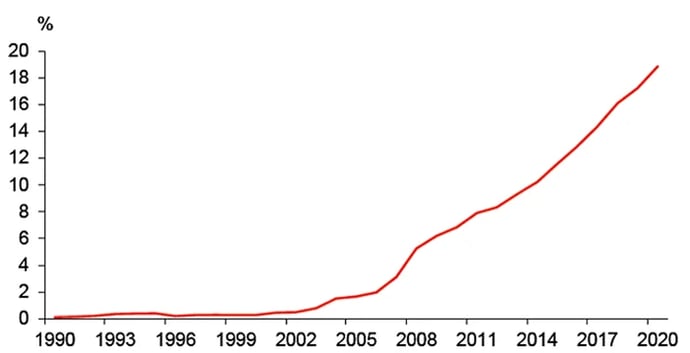

Unfortunately, this trend doesn't appear likely to reverse in the near term. One significant reason for this is that there are now three times as many "zombie companies" – companies with debt service costs higher than profits – compared to the Great Financial Crisis. In fact, "zombies" currently make up almost 20% of the entire US debt market (chart below). Even if these companies manage to continue servicing their existing debt, they will eventually need to refinance which will pose a threatening challenge given today's prevailing rates.

US: Rising Share of Companies with Debt Servicing Costs That Are Higher Than Profits

(US: Share of "Zombie" Firms)

Note: Firm-level data is used to calculate the share of listed firms that are more than

ten years old with an interest coverage ratio less than one for three years in a row.

Source: Datastream, Worldscope, DB Global Research

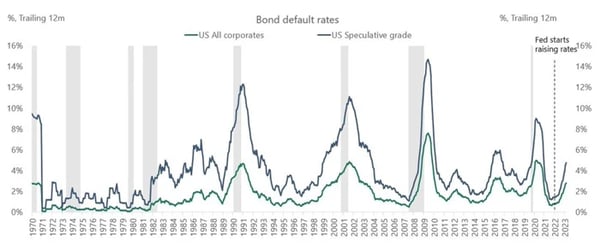

Entering a New Default Cycle

We might already find ourselves in the midst of this reality. This week, Apollo declared that a new default cycle has already begun, and it's not limited to just "zombies." According to Apollo, default rates on all US corporate bonds have nearly tripled from their lows of around 1% in 2021. Since the Fed started raising rates, the default rate on all US corporate bonds has risen to 3%. On speculative-grade bonds, default rates have surged from 1.5% to 5% in just over a year (chart below).

A Default Cycle Has Started

Source: Apollo

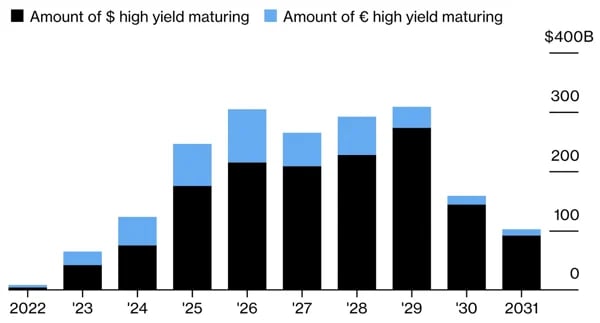

The Maturity Wall

An encouraging factor is that a significant number of companies capitalized on historically low rates from 2020 to 2022, refinancing their debt and extending maturities for several years. While we will witness a rise in maturities in 2024, the "maturity wall" will truly come into play in 2025 and 2026 (chart below). This provides some breathing room for the Federal Reserve to bring rates down to a more manageable level before many companies are forced to seek new debt.

Breathing Room

Source: Bloomberg

Of course, the Fed's primary mandate isn't to prevent corporate defaults but to control inflation. They have made it clear that they want to see inflation at 2% before considering rate reductions, which could take a while. Inflation, as measured by the Consumer Price Index (CPI), stood at 3.7% for August, marking its second consecutive monthly increase after hitting a cycle low of 3.0% in June. As we've previously discussed, reducing inflation from 9% to 4% is a far easier task than bringing it down from 4% to 2%, and it seems that further challenges in the battle against inflation are on the horizon.

Food-flation

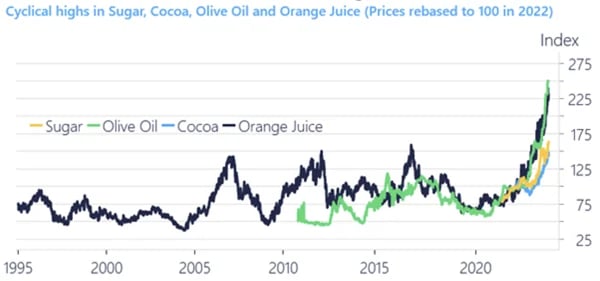

While much attention has been focused on rising oil prices, with WTI Crude Oil futures surpassing $90 a barrel last week, there are other commodities on the ascent that will also contribute to inflation. Notably, soft commodities are likely to have a negative impact on food prices moving forward. Futures for sugar, cocoa, olive oil, and orange juice, among others, have all experienced significant price spikes, with orange juice and olive oil surging by over 100% year over year and reaching record highs (chart below).

Traded Food-Flation is THROUGH the ROOF Again

Source: Steno Research, Bloomberg and Macrobond

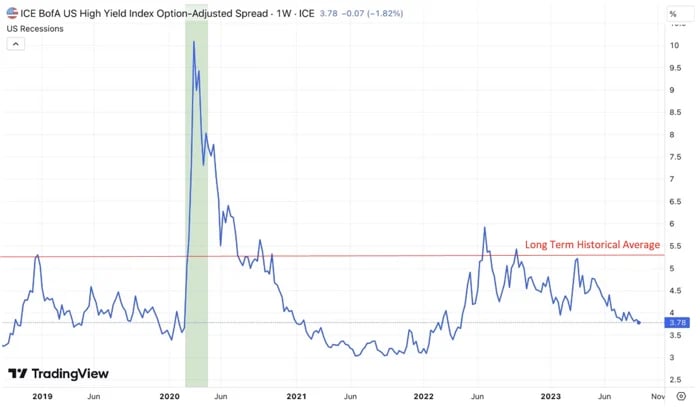

Higher for Longer

These escalating input costs suggest that higher (or at least not lower) inflation will persist for some time, which in turn implies that the Federal Reserve is unlikely to lower rates anytime soon. This exacerbates the current stress in the bond market. Interestingly, the high yield bond market, which is most susceptible to the impacts of prolonged higher rates, appears to be shrugging off this threat. The ICE BofA US High Yield Index Option-Adjusted Spread, which measures the spread between high yield bond yields and corresponding Treasury yields, has been declining since mid-March, dropping to 3.79% as of last Friday – well below its long-term average of 5.39% (as shown in the chart below). This means investors are demanding 1.6% less relative return for these bonds compared to Treasuries than the historical average, despite growing stress in this market.

As we discussed in our June 15th Market Insights piece, the only one certainty regarding the current situation is that something must change. Either rates must come down to more manageable levels for companies seeking to refinance debt, or the market will collide headfirst with the maturity wall, leading to a cascade of bankruptcies. For bond investors, both of these scenarios offer opportunities for profit. The key is to be agile enough to navigate potential pitfalls and seize the opportunities they present.

Forward-looking statements are based on management’s then current views and assumptions and, as a result, are subject to certain risks and uncertainties that could cause actual results to differ materially from those projected. This market insight is for informational purposes only and should not be construed as a solicitation to buy or sell, or to invest in any investment product or strategy. Investing involves risk including loss of principal.