Optimus Advisory Group - Commentary

by Craig Love, on March 01, 2023

If we are in an extended period of high inflation, then it makes sense to invest in those areas of the market that have traditionally performed well during times of high inflation. Our Inflation Opportunities and Strategic Inflation ETF strategies do just that by utilizing our adaptive, multi-factor proprietary system to identify strong inflation-fighting ETFs for inclusion in the portfolio.

ECRI, the leading predictor of cycle turning points, published an article on February 23rd, 2023 on their website (www.businesscycle.com) regarding long-term cyclical inflation.

Why the 1970s clarify the Fed’s actions today

It’s important to understand that the cyclical nature of inflation is quite different from inflation’s structural characteristics.

The risks

If “mission accomplished” for the Fed in 2023 is merely a cyclical downturn in inflation, that would fall far short of securing Fed Chairman Jerome Powell’s legacy.

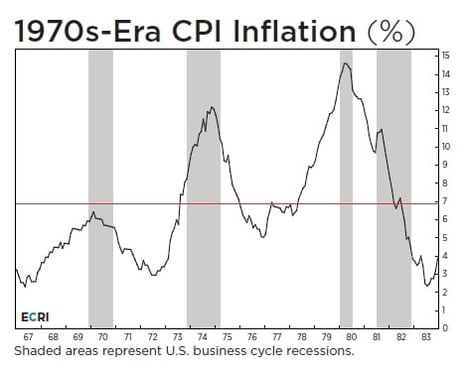

We’ve seen this movie before. From the 1970s to the early 1980s, inflation cycled from less than 3% to nearly 15%. Around each recession, inflation would cycle down but, with the cycle lows becoming progressively higher, inflation averaged about 7% (chart).

A cautionary tale

Every time inflation cycled down, there was intense political pressure from Congress and the White House on Fed Chairman Arthur Burns to back off. AFL-CIO President George Meany called Burns "a national disaster," and Senator Hubert Humphrey compared him to Simon Legree, the villainous slaveowner in Uncle Tom’s Cabin. Each time, Burns gave in and backed off too soon in his fight against inflation, opening the door to a structural upshift in inflation.

By the time Fed Chairman Paul Volcker came on the scene, people were sick and tired of inflation to the point that there was no longer much pushback against sustained monetary tightening, despite recession. So, in that respect, Volcker was luckier than Burns.

Under the circumstances, it makes sense for Powell to be cautious in declaring that the Fed’s inflation fighting job is done, even as economic weakness spreads.

Last March, Senator Richard Shelby asked Powell if he was prepared to “do what it takes to get inflation under control and protect price stability.” Powell replied that he “knew Paul [Volcker]” and thought “he was one of the great public servants of the era, the greatest economic public servant,” and that he hoped “history will record the answer to your question is, ‘yes.’”

Optimus strategies are offered as separately managed accounts and can be accessed via Fulcrum Equity Management.

Source: Optimus Advisory Group